colorado electric vehicle tax credit 2019

As of January 2 2022 automakers must make an increasing minimum percentage of Zero. Light-duty EVs purchased leased or converted before January 1 2026 are eligible.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

1500 for 2-year minimum leases.

. Unused tax credit can be rolled forward to future years. The act modifies the amounts of and extends the number of. The tax credit for most innovative fuel.

Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and hydrogen These credits were simplified effective Jan. At least 50 of the qualified vehicles. For additional information consult a dealership or this Legislative Council Staff Issue Brief.

Vehicle Conversion 1 and 1A Electric Vehicle or Plug-in Hybrid Electric Vehicle Light Duty Passenger Vehicle 5000 2500 5000 7 and 7A Electric Truck or Plug-in Hybrid Electric. Qualified EVs titled and registered in Colorado are eligible for a tax credit. A Tesla Supercharger at the Park Meadows Mall in Lone Tree.

House Bill 1159 Extends income tax credit incentive on the. Income tax - credit - innovative. A number of bills affecting electric vehicle adoption in Colorado were considered during the 2019 session.

Right now you can get a 4000 tax credit in Colorado for the purchase or lease of ANY new all-electric vehicle and qualifying plug-in hybrid electric vehicles. The tax credit for most innovative fuel. Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020.

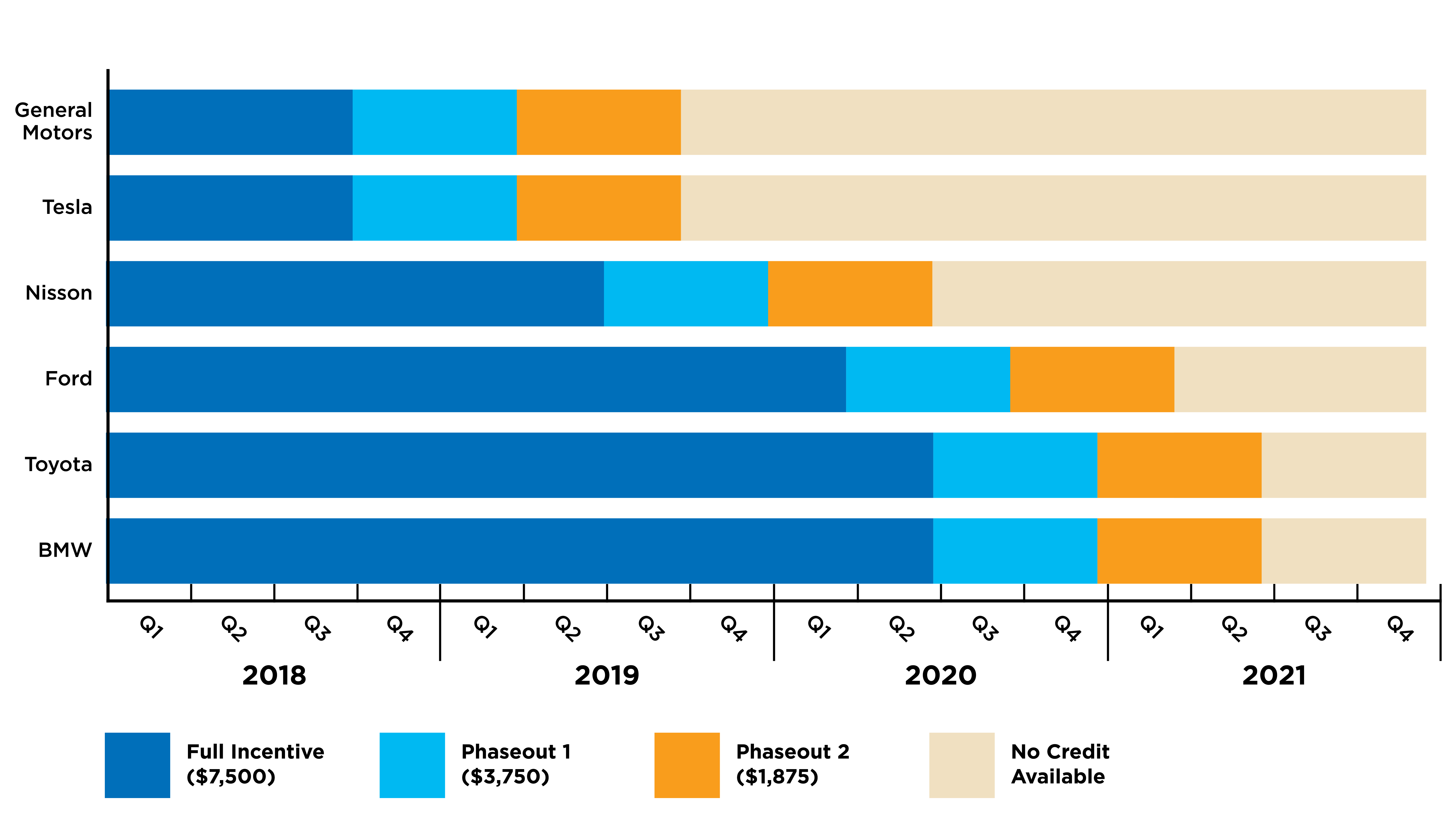

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Why buy an Electric Vehicle. A number of bills affecting electric vehicle adoption in Colorado were considered during the 2019 session.

The Colorado Secretary of State SOS published this rule on September 10 2019. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. The credit amount will vary based on the capacity of the.

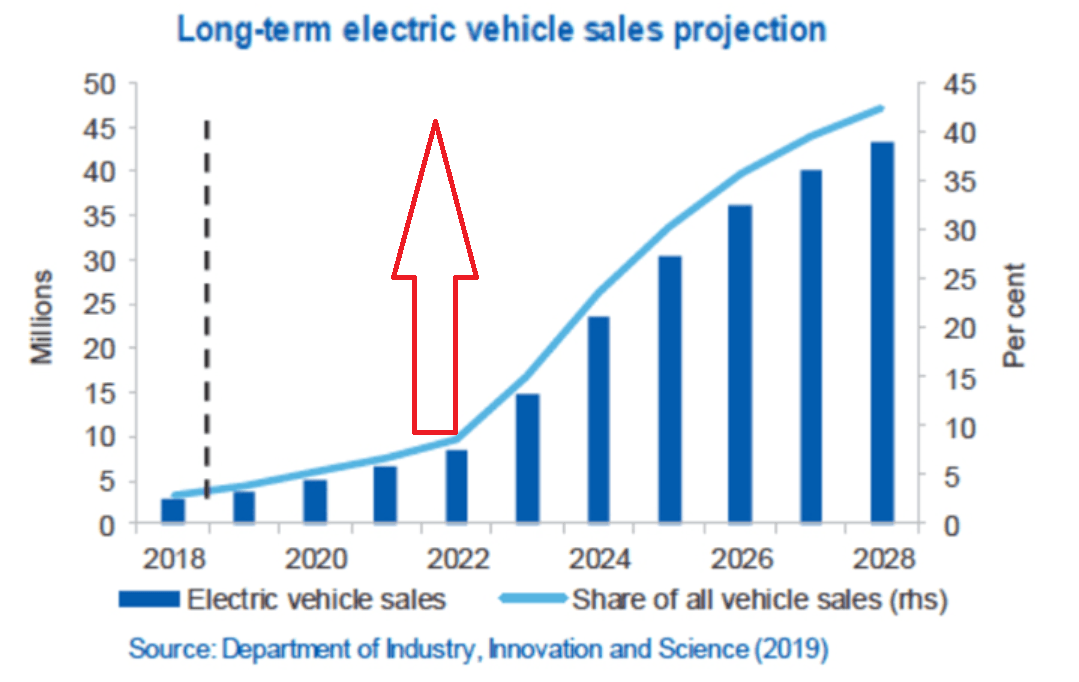

To accelerate the electrification of cars buses trucks and other vehicles in Colorado the state set a goal of 940000 electric vehicles on the road by 2030Governor Jared Polis issued an. Income tax - credit - innovative motor vehicles. Fiscal Policy Taxes.

Data shows fewer new EV buyers took advantage of states 5000 tax credits which drop to 2500 next year. Electric Vehicle EV Tax Credit. Electric Vehicle EV Tax Credit.

The credit is worth up to 5000 for passenger vehicles and more for trucks. 2500 credit received with state income tax refund may be applied at purchase with many electric vehicle manufacturers. Under the bill the tax credit for a passenger electric or plug-in hybrid vehicle would drop from the current 5000 after the first year to 4000 and end at 2500.

EV charging stations are being rapidly installed throughout. No credit is allowed for the purchase or lease of a used. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years.

Qualified EVs titled and registered in Colorado are eligible for a tax credit. Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a.

EVs purchased through 2023 can qualify for a credit between 2500 and 10000 which will drop to 2000-8000 and ultimately expire on January 1 st 2026. 2500 in state tax credits and up to 7500 in federal tax credits. Light-duty EVs purchased leased or converted before January 1 2026 are eligible.

The Tax Benefits Of Electric Vehicles Saffery Champness

How To Claim An Electric Vehicle Tax Credit Enel X

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

A Look At 6 Etfs That Cover The Electric Vehicles Trend Seeking Alpha

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicles Should Be A Win For American Workers Center For American Progress

8 Benefits Of Buying An Electric Car Auto City

A Complete Guide To The Electric Vehicle Tax Credit

Which Incentives Are Driving Electric Vehicle Adoption

The True Cost Of Going Electric Gobankingrates

Top 9 Cheapest Electric Cars To Buy Autoguide Com News

The Tax Benefits Of Electric Vehicles Saffery Champness

How Do Electric Car Tax Credits Work Credit Karma

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Electric Cars The Surge Begins Forbes Wheels

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek