vermont sales tax exemptions

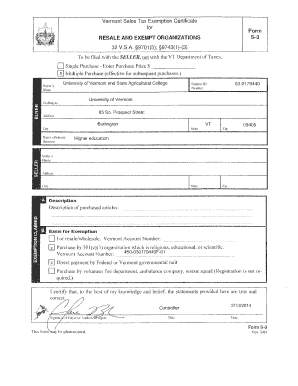

The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate. 974114 15 16 24 Form S-3M ˇ ˆ SELLER.

Sales Tax By State How To Verify A Resale Certificate Business Tax Deductions Small Business Tax Deductions Sales Tax

The sales tax exemption is only intended to be used for inventory that will be resold and not intended for the tax-free purchase of items used in normal business operations.

. Ad Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now. A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the. The Vermont Sales Tax is applied to commercial sales of heating fuel.

Retail sales and use of the following shall be exempt from the tax on retail sales imposed under section. Ad Have you expanded beyond marketplace selling. Ad Fill out a simple online application now and receive yours in under 5 days.

Avalara can help your business. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. Ad New State Sales Tax Registration.

Purchase Use tax Exemption. Vermont Sales Tax Exemption Certificate for MANUFACTURING PUBLISHING RESEARCH DEVELOPMENT or PACKAGING 32 VSA. Local jurisdictions can impose.

Used for organizations wishing to become certified as exempt from PU tax. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from. What is Exempt From Sales Tax In Vermont.

The exemption reduces the appraised value of the home. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services.

Do Vermont sales tax exemptions expire. 9741 9741. Business and Corporate Exemption Sales.

Ad Have you expanded beyond marketplace selling. 53 rows Exempt from sales tax on purchases of tangible personal property and meals not rooms. Counties and cities can charge an additional local sales tax of up to 1 for a.

Ad Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now. The tax also applies to sales of dyed diesel sold in bulk if the fuel is for non-propulsion use. State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000.

Ad Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now. Avalara can help your business. How to use sales tax exemption certificates in Vermont.

Purchase and Use Tax Computation - Leased Vehicle. Form S-3 Vermont Sales Tax Exemption Certificate for Purchases For Resale And By Exempt Organizations 34396 KB File Format. A seller who accepts an exemption certificate in good faith is relieved of liability for collection or payment of the Vermont Sales and Use Tax otherwise due on tangible personal property.

State Sales Tax Exemptions information registration support. Vermont has a statewide sales tax rate of 6 which has been in place since 1969.

Vt Vs Svt With Aberrant Conduction Conduction Jitra Algorithm

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Sales Tax By State Is Saas Taxable Taxjar

Tax Exemption Google Search State Tax Tax Exemption Agreement Quote

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Vermont Sales Tax Small Business Guide Truic

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Buying Tax Sale Tax Deed Properties Without Bidding Over The Counter Otc Bank Owned Properties Things To Sell Bid

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

All Retailers Not Collecting Sales Tax From Purchasers In Colorado Kentucky Louisiana Oklahoma Rhode Island S Floral Craft Bottle Opener Wall Craft Tools

The 10 Best States For Retirees When It Comes To Taxes Retirement Locations Retirement Retirement Advice

Printable Vermont Sales Tax Exemption Certificates

State By State Guide To Taxes On Retirees Retirement Tax States

Vt Vs Svt With Aberrant Conduction Conduction Jitra Algorithm

States With Highest And Lowest Sales Tax Rates

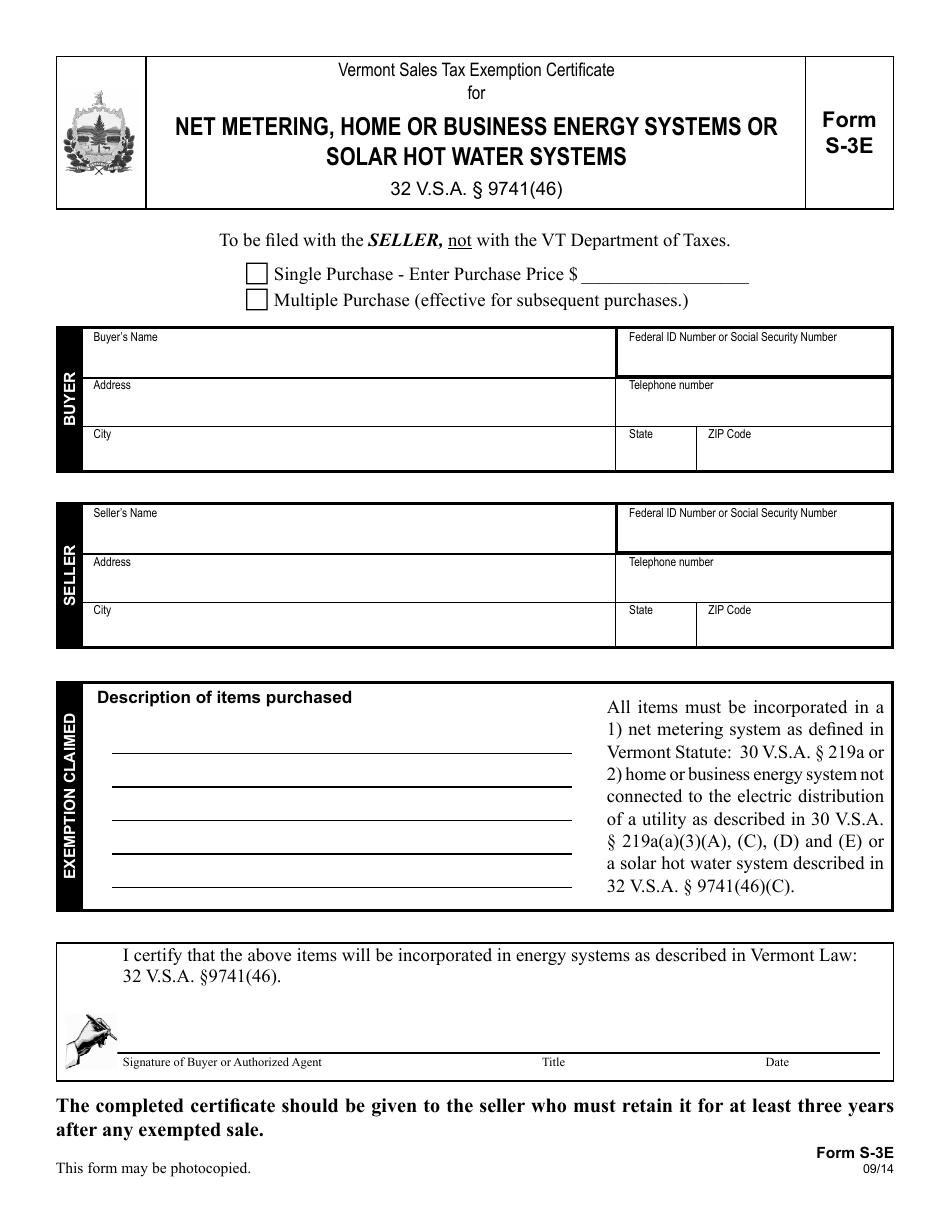

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

Sales Tax By State Economic Nexus Laws Nexus Business Tax Sales Tax