quitclaim deed colorado taxes

If the giver inherited the home and then executed the quitclaim deed to another person the person gifted the property could sell without paying capital gains tax. Transfer property in Colorado quickly and easily using this simple legal form.

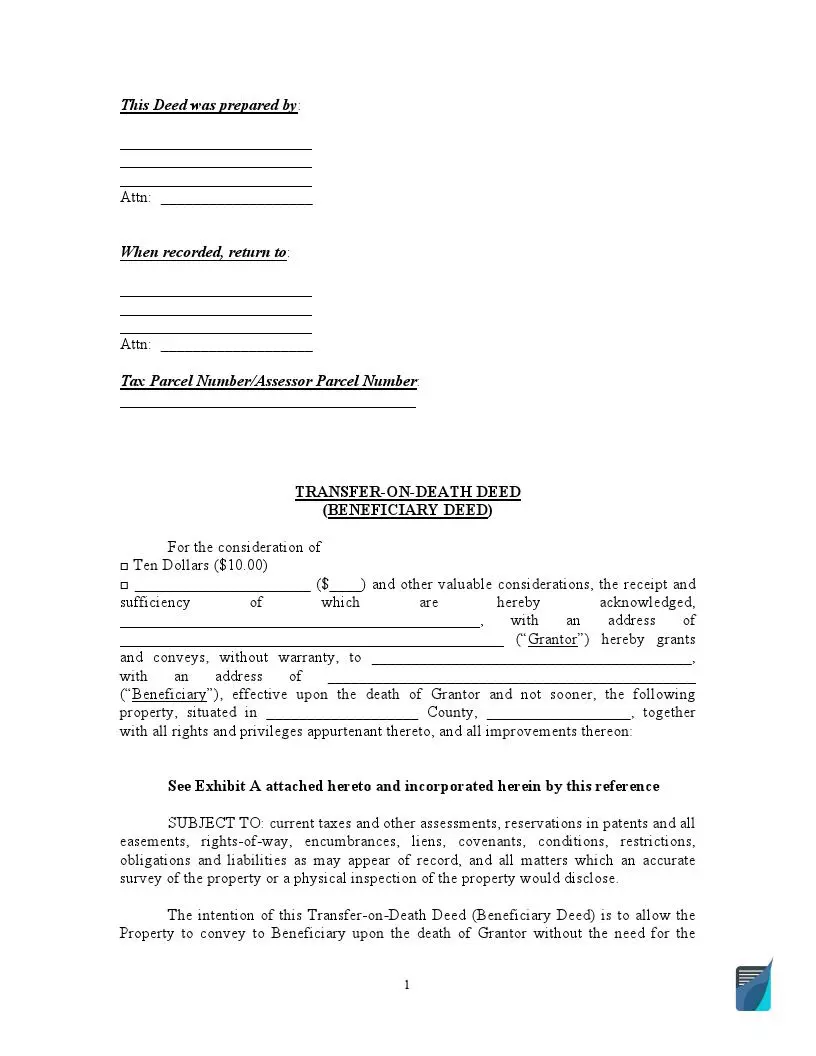

Free Transfer On Death Tod Deed Form Pdf Template

Transfer Property Interest from One Person to Another.

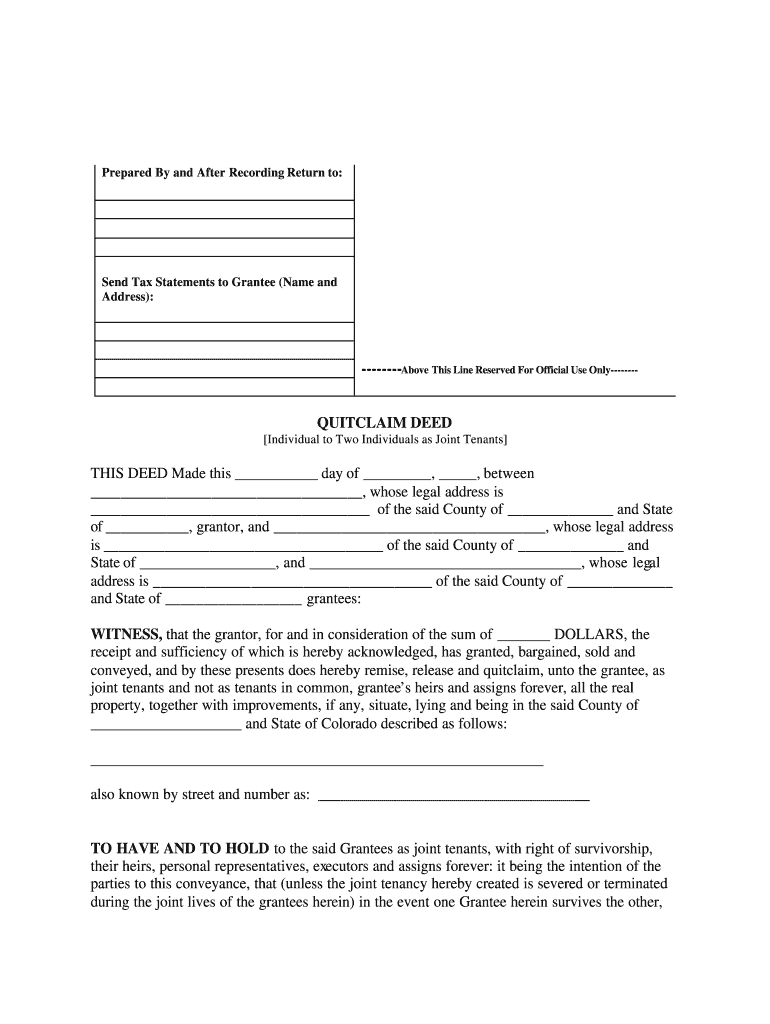

. Name and address of the preparer Name and address of the party that will receive tax notices Amount of consideration given for the property Grantors person selling or gifting the property name marital status. The transfer is considered a gift to the other joint tenant. A quitclaim deed is not generally used in a traditional sale of real estate.

One key thing to do is waive rights to the property and demonstrate that you no longer claim it and you can do this using the Colorado Quitclaim Deed Form. Quitclaim deeds Search Results for quitclaim deeds in the Colorado Legal Forms Library Skip to Main Content Search 35 forms found co-02-77 co-021-77 co-022-77 co-023-77 Real Estate - Deeds - Quitclaims. This means that the tax lien investor essentially becomes the owner of the property through a conveyance from the county treasurers office hence the name treasurers.

You can use a quitclaim deed to. Start 30 days free trial. Save Time Editing PDF Documents Online.

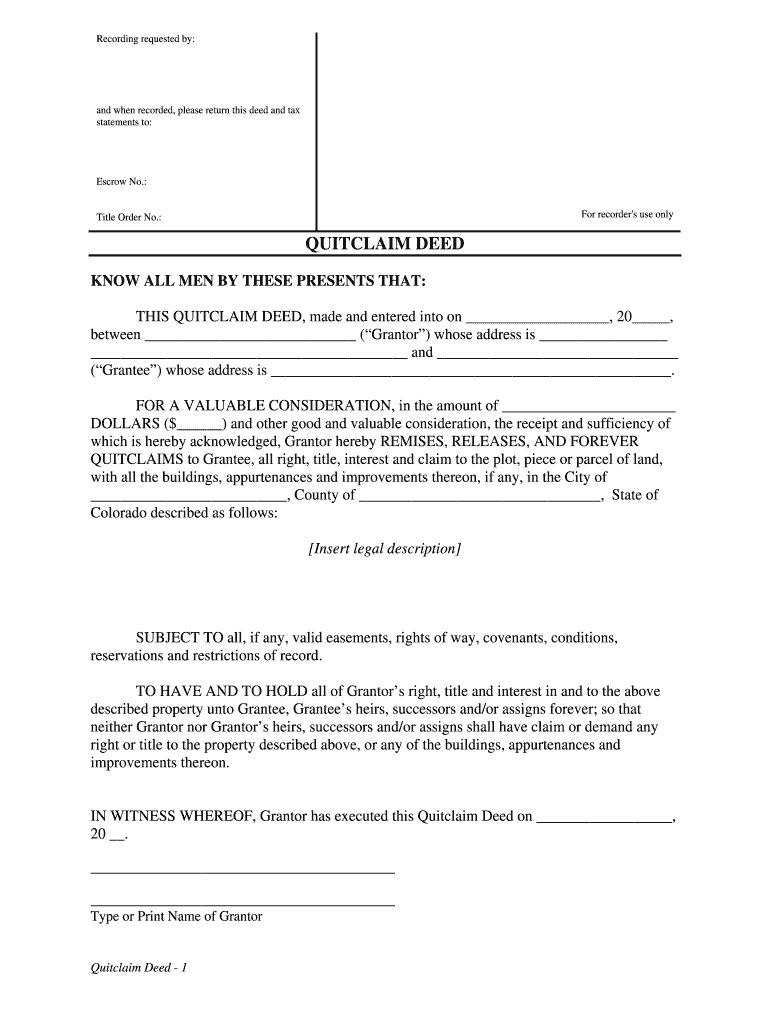

So instead of The seller conveys the property to the buyer it must state the seller quitclaims the property to. Plats are assessed a recording fee of 13 for the first page and 10 for each additional page. Nov 09 2020 other taxes such as federal income tax gift tax or inheritance tax may also be incurred by a.

Tax code gift taxes are paid by the giver so the brother would have to fill out a gift tax form 709 and he can apply the value of half the house to the lifetime maximum of 55 million he can give away under current estate tax rules. In Colorado a warranty deed that includes the words warrants the title automatically implies the usual. Ad Quitclaim Deed More Fillable Forms Register and Subscribe Now.

In the deed form you will write your name as the grantor and the name of the property recipient the grantee. Nov 21 2019 a quitclaim deed often mistakenly referred to as a quick claim deed is a document that is used to transfer your interest in a property. As to the tax question the IRS will view the addition of the letter writer via quitclaim deed as a gift.

Quitclaim deed colorado taxes. Unlike warranty deeds there are no protections offered to the grantee in that the deed is free of problems. In most cases that gift does not trigger any transfer tax.

Ad Answer Simple Questions To Make Your Quit Claim Deed. With a quitclaim deed you can easily release the property and waive the rights to operate it. Be sure to specify that the deed is for Colorado.

However if a tax lien investor holds a tax lien for 3 years without a redemption then the investor can apply for and acquire a treasurers deed from the county. Ad Legally Binding Quit Claim Deeds Colorado. A Colorado quit claim deed is a legal contract used for conveying real property land andor physical structures from the current owner grantor to the new owner grantee.

A quit claim deed can be obtained from an attorney a real estate agent from one of the many businesses that sell legal documents or even downloaded online. To write a Colorado quitclaim deed you will need to provide the following information. Transfer property to or from a revocable living trust.

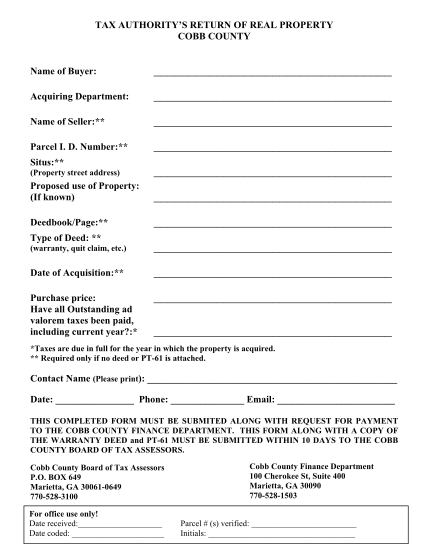

Ad save time editing pdf documents online. Legal Forms Library Colorado Legal Forms Search. Transfer documents Warranty Deeds Quit Claim Deeds etc will be assessed a documentary tax if the consideration is 500 or more in addition to the recording fee.

18 The filing fee includes a 300 surcharge earmarked for Colorados electronic recording filing fund. Transfer documents Warranty Deeds Quit Claim Deeds etc will be assessed a documentary tax if the consideration is 500 or more in addition to the recording fee. A quit claim deed Colorado is only generally used between people who are very close because it does not make any guarantees that the grantor the person selling or giving away the property is the actual owner of the property.

The word quitclaim must be used instead. A quitclaim deed is often used in transfers between family members to add or remove someone from title to add or remove property from a living trust or to change ownership from joint tenants to tenants in common when a warranty deed is not needed. Most documents legal size or smaller are assessed a 13 recording fee for the first page and an additional 5 recording fee for each additional page.

If the giver was gifted the home via a quitclaim deed and then executed a quitclaim deed to another person the person gifted the property would be on the hook for capital gains tax if he chose to sell the. Create Legal Documents Using Our Clear Step-By-Step Process. The documentary tax is.

The Disadvantages of a Quitclaim Deed in Colorado. Create in 5-10 Minutes. In Colorado a quit claim deed is a legal document used to transfer property from an owner to a seller in an expeditious fashion.

Under the terms of the US. The person requesting recording of a Colorado deed must pay a filing fee of 1300 for the first page and 500 for each additional page. Transfer one co-owners interests to another co-owner.

Should the property have an existing lien for example the grantee would absorb the responsibility of. Tax Forms Attorney Directory External Links Law Digest Legal Q A LegalLifee Articles. And QUITCLAIMED and by these presents does remise release sell and QUITCLAIM unto the Grantee and the Grantees heirs and assigns forever as _____ all of the right title interest claim and demand that the Grantor has in and to the real property together with the fixtures and.

Instead a quit claim deed Colorado only quits gives up any interest in the property that the grantor might. Who signs a quit claim deed in Colorado. The excluded amount is taken off the taxpayers total allowable lifetime exclusion.

However a gift of more than 1200000 should be reported on a gift tax return. If the transferor of a quitclaim deed in a home sale lived in the home as a primary residence at least two years of the past five capital gains of up to 250000 500000 if the quitclaim is conveyed by a couple filing jointly are excludable from tax. The problems with using a Colorado quitclaim deed as a transfer on death deed are numerous.

The colorado quit claim deed is a legal document that is used when a grantor seller is selling a parcel of land to a grantee buyer. The only parties required to sign the quit claim deed are the grantor and the notary public. Also to know how does a quitclaim deed work in Colorado.

Transfer property to one spouse as part of a divorce.

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Approved Getting Into Real Estate Real Estate Tips Moving Tips

Should I Sign A Quitclaim Deed During Or After Divorce

Laurent Carrier Financial Colorado Springs Estate Planning Money Management How To Plan

Colorado Quit Claim Deed Fill Online Printable Fillable Blank Pdffiller

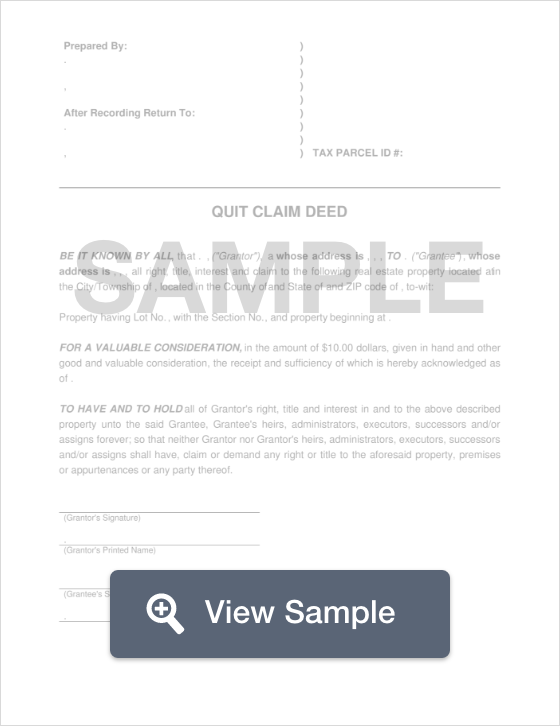

Quit Claim Deed Form Free Quit Claim Deed Template With Sample Quitclaim Deed Templates Printable Free Funeral Program Template

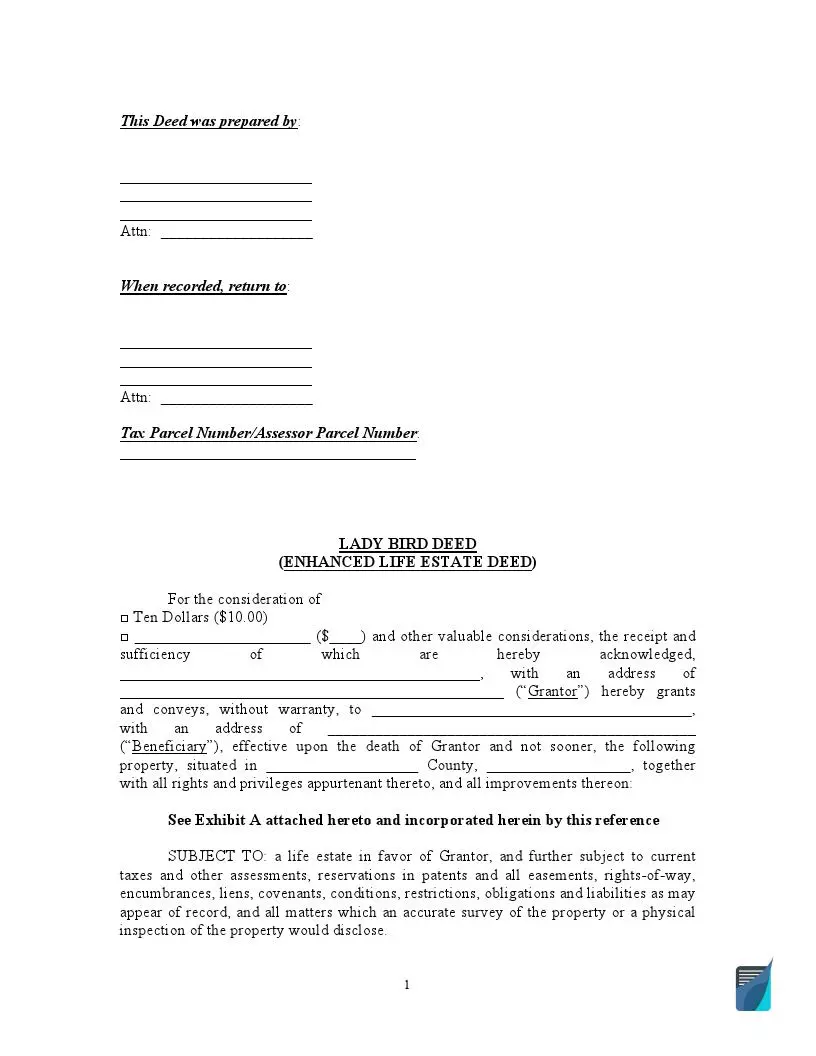

Free Lady Bird Deed Form Enhanced Life Estate Deed

The Mega Profit Potential Of Apartment Syndication Double Your Money Retirement Planner Retirement Best Places To Retire

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quick Claim Form 12 Facts You Never Knew About Quick Claim Form Quitclaim Deed Doctors Note Template Letter Templates Free

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed What Are The Tax Implications Money

Free Special Warranty Deed Make Save Rocket Lawyer

126 Quitclaim Deed Form Page 8 Free To Edit Download Print Cocodoc

I Signed Over My House To My Daughter How Do I Reverse That The Washington Post

How Much Is A Quid In Us Currency Scramble Words Bitcoin Account Slang Words

Moving Checklist Realestate Realestateagent Realestatebroker Realtor Listing Realestatelisting Listingpresentation R Moving Checklist Checklist Moving

Is A Quitclaim Deed Subject To Tax Deeds Com

Quitclaim Deed Colorado Fill Out And Sign Printable Pdf Template Signnow